Mobile Customer Onboarding –

Powered by Cryptomathic and Esysco.

New digital portal streamlines banking client onboarding while addressing AML, eIDAS and PSD2 requirements

In an effort to facilitate digital transformation, reduce operational costs and accelerate customer onboarding, numerous banks and financial institutions consider setting up a fully digital client onboarding solution with a Remote and Qualified eSignature service at the end of the onboarding process. Most organisations opt for remote onboarding and utilise the numerous service providers that emerged in the last decade.

A large portion of the clientele will, however, always opt for a physical onboarding where the customer advisor interacts with the client in-person. That said, the onboarding process needs to be transformed to allow for increased efficiency, improved compliance demonstration and to enhance the digital banking business.

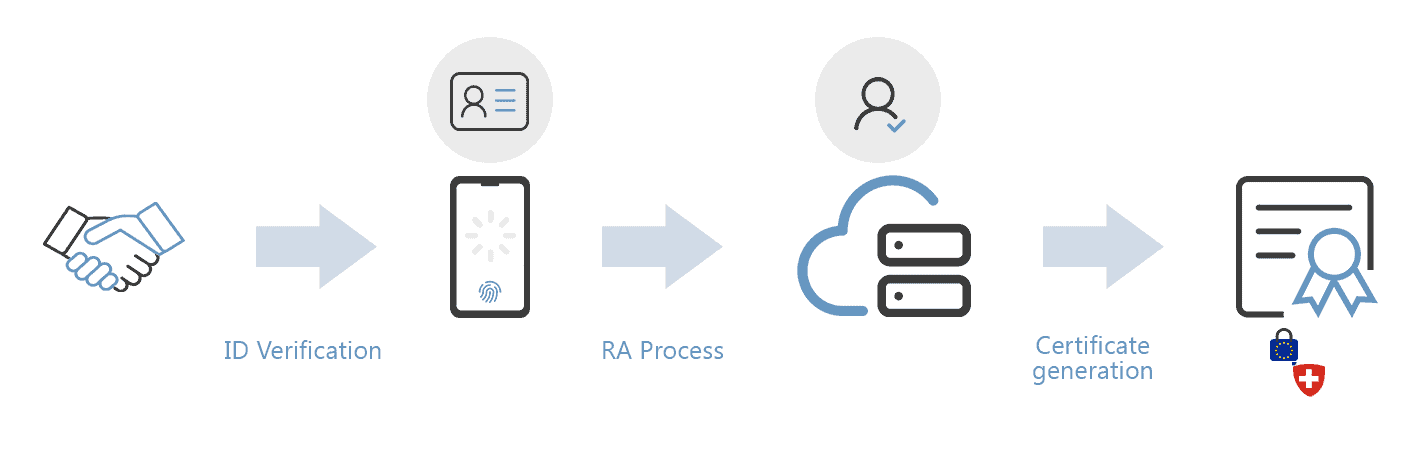

Together with Cryptomathic, we have developed a digital onboarding portal for the financial sector, in combination with a smartphone app that:

In short, the solution aims to:

Need To Talk Now?

DO YOU HAVE A BIG IDEA WE CAN HELP WITH?